LegalShield Data Reveals Mixed Consumer Experience: High Bankruptcy, Lower Stress

- LegalShield’s Consumer Stress Legal Index eases a 10-month rise post-holiday

- LegalShield predicts a rise in household bankruptcies through second quarter, based on rising calls for legal help

- LegalShield Provider Attorney: “Consumers we talk to only have enough money to cover some of their bills…”

LegalShield released its January Consumer Stress Legal Index (CSLI) showing a slight decline in overall stress, but a nearly 4-year high in bankruptcy inquiries. Rising calls for help with bankruptcies signal a rise in personal bankruptcies through the second quarter.

LegalShield’s primary index, the CSLI, declined 3.2 points to 63.5, principally due to a seasonal decline in overall consumer finance inquiries.

“Our data bucks prevailing wisdom: While we saw the expected seasonal easing of consumer stress felt by our members, we just posted a post-pandemic record for bankruptcy inquiries,” said LegalShield CEO Warren Schlichting. “Despite the headlines, our data implies we’re not out of the woods yet, and we believe policymakers should remain attentive to the economy of everyday Americans.”

LegalShield’s CSLI was launched in 2018 and is based on a dataset of more than 35 million consumer requests for legal assistance since 2002. The index is built on three sub-indices tracking calls for legal assistance for issues related to Consumer Finance, Bankruptcy and Foreclosure. LegalShield receives approximately 150,000 contacts each month from consumers seeking legal help in more than 90 areas of law, including key consumer issues.

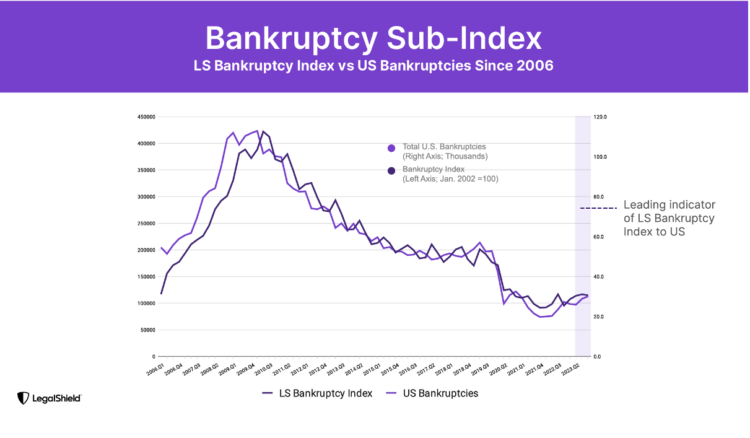

Bankruptcy Index Predicts Rise in Filings for 6 Months

LegalShield’s Bankruptcy Index rose 2.5 points, increasing for a fifth straight month and reaching its highest level since March 2020. Pandemic relief measures drastically reduced bankruptcy filings for several years. The LegalShield Bankruptcy Index historically leads actual bankruptcy filings as reported by the U.S. court system by two quarters, with a .98 correlation.

“The calls to LegalShield provider attorneys for bankruptcy advice continue to increase, sustaining a trend we’ve seen since late 2022,” said Matt Layton, LegalShield’s SVP of Consumer Analytics. “Despite several positive macroeconomic signs, people are feeling pinched to the point of calling a lawyer in seek of relief. As we’ve seen a reaction to the January inflation numbers, clearly more people are falling short of their financial obligations and the data indicate the trend will grow through the first half of this year.”

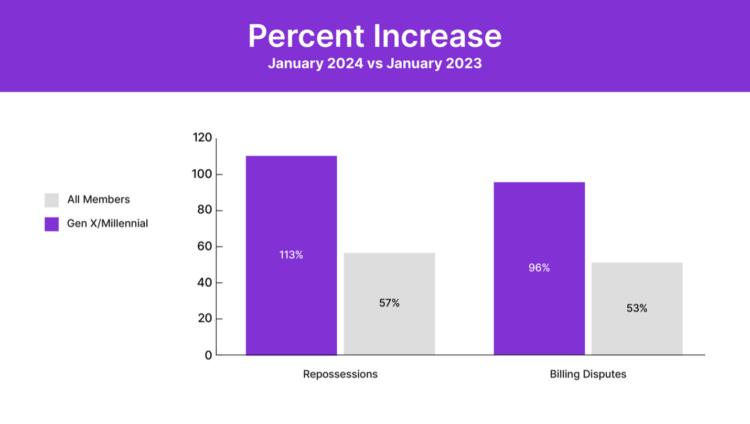

Gen X and Millennials Hit Harder on Consumer Finance Issues

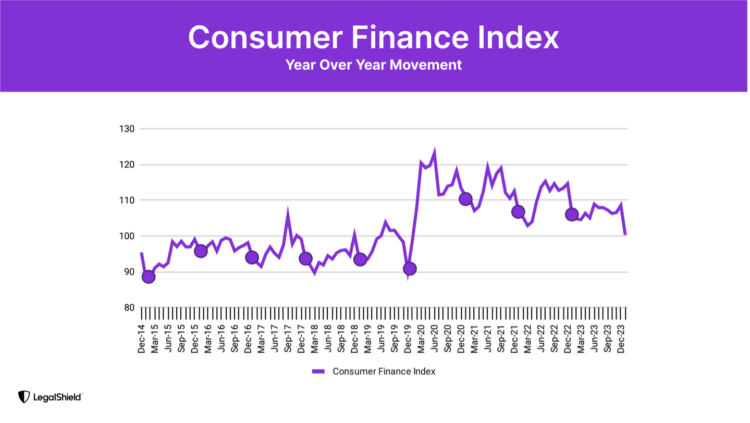

LegalShield’s Consumer Finance Index declined 8.3 points in January to 100.3, matching an annual seasonal trend. The Consumer Finance Index has declined in January in 9 out of the last 10 years, and historically edges down through the first quarter.

Despite the overall drop in consumer finance inquiries, calls about car repossessions and billing disputes continue to rise, especially for Gen X and Millennials. Calls to LegalShield provider attorneys regarding repossessions are at their highest level since April 2021, with Gen Xers and Millennials calling at more than twice the rate of January last year. Questions about billing disputes are up 53% year over year for all LegalShield members, but up 96% for Gen X and Millennials.

LegalShield provider attorney in Texas, John Saltarelli, cites three prevailing pressures driving the uptick in inquiries about bankruptcies, repossessions and billing disputes: credit card defaults, aggressive collections, and inflation.

“Consumers we talk to only have enough money to cover some of their bills, so they prioritize a roof over their head ahead over other expenses, racking up high interest credit cards,” said Saltarelli. “Collectors are turning up the heat after the pandemic, and increasing inflation makes what money people do have, worth less.”

U.S. household debt hit a record $17.5 trillion in the fourth quarter of 2023, as reported by the Federal Reserve Bank of New York in early February. Delinquency rates on record credit card debt and auto loans hit their highest levels since the Great Recession.

“People are asking us to help assess options such as payment plans, or even file for bankruptcy,” said Saltarelli. “Most of these folks want to pay their bills and meet their obligations, but they’re reaching a breaking point. While difficult, they get relief knowing an attorney who has seen this before is helping them navigate a new plan.”

Foreclosure Index Range Holds Steady

The third sub-index of the CSLI, LegalShield’s Foreclosure Index, decreased 4.4 points in January to 38.4. The Foreclosure Index has held relatively steady, with January just slightly below the two-year average of 39.5.

Since its inception, the CSLI has been a 60-90 day leading indicator of the Conference Board’s closely watched Consumer Confidence Index with a correlation level of –0.85.

###

About the LegalShield Consumer Stress Legal Index:

As part of LegalShield’s mission to ensure every person has equal access to justice, we mine our data for insights policymakers can use to make a real, positive impact in their decision making. Released monthly, the LegalShield Consumer Stress Legal Index is comprised of three sub-indices which reflect the demand for various legal services. LegalShield’s dataset includes more than 35 million consumer requests for legal assistance since 2002, averaging approximately 150,000 calls received monthly. The CSLI uncovers the daily challenges people are facing and provides actionable intelligence to help policymakers and industry leaders bridge those gaps.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world’s largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses, and employers with tools and services needed to affordably live a just and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to thousands of qualified, trusted attorneys and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.

LegalShield Media Contact:

Hollon Kohtz, Director of Communications

[email protected]